How Aluminum Tariffs Impact Manufacturers & Metal Finishers

On June 4, 2025, the U.S. raised its Section 232 aluminum tariff from 25% to 50%, significantly altering the cost dynamics for manufacturers and finishers nationwide. This shift touches anyone who sources, processes, or finishes aluminum, from industrial fabricators to surface specialists, forcing strategic adjustments in pricing, sourcing, and operations.

Aluminum Prices: Premiums Surge

Immediately following the tariff increase, the Midwest premium—the extra cost U.S. buyers pay over global benchmark prices jumped from around 38¢/lb to 62–63¢/lb ($1,377–1,393/ton). Analysts warn that it could climb further to 70–76¢/lb, due to logistics, tariff pass-through, and tight supply chains.. In practical terms, any company buying aluminum or finished aluminum products faces significantly elevated input costs.

Broader Business Impacts

For manufacturers of consumer products, automotive parts, packaging, or structural components, the surge in aluminum prices immediately increases their cost of goods sold. These costs often ripple down the supply chain, squeezed between cost-sensitive customers and reluctant buyers. The volatility also complicates budgeting and planning, as firms juggle unpredictable raw-material expenses.

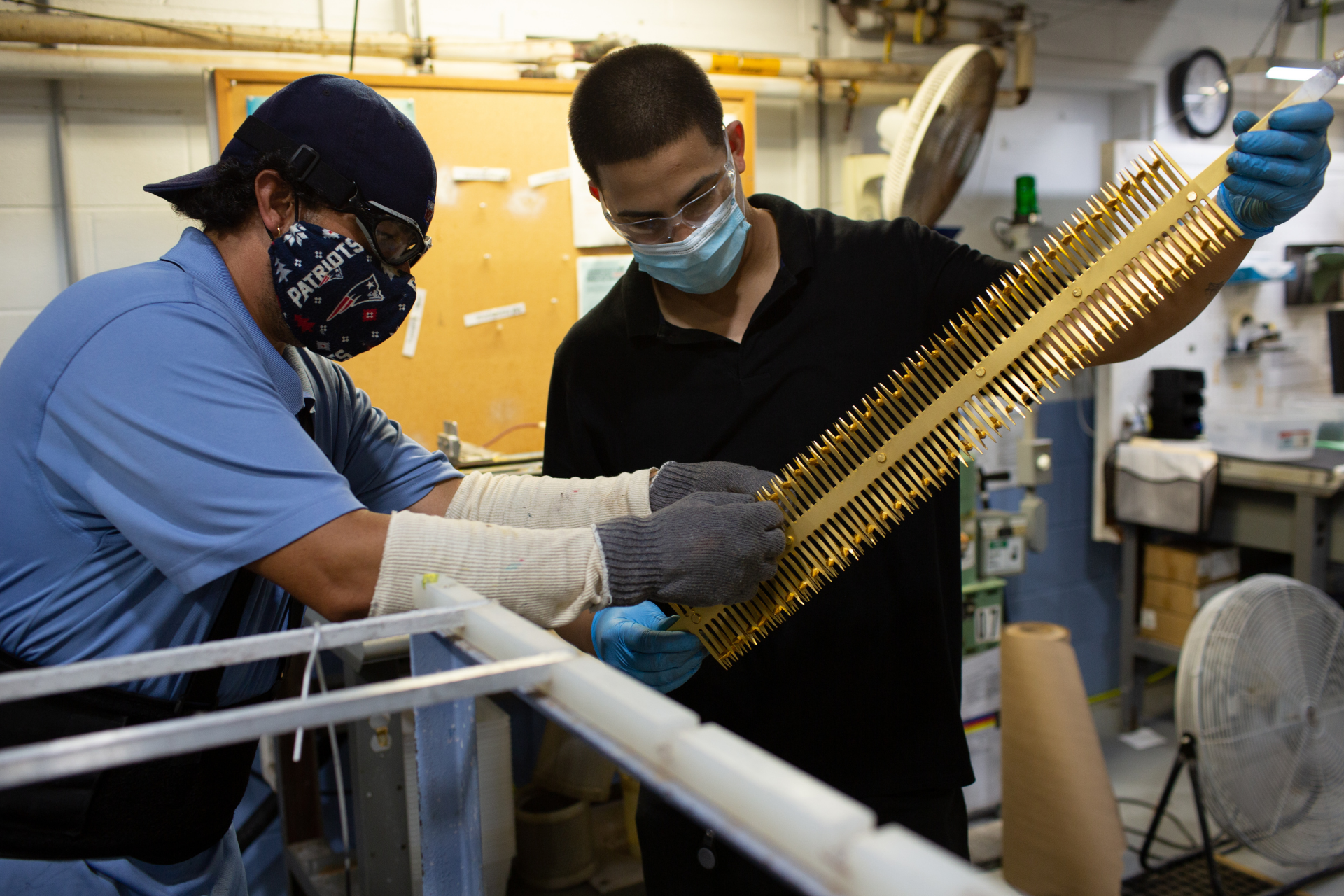

Pressure on Metal Finishers

Anodizers, platers, polishers, or custom finishers buying aluminum sheet, extrusions, or cast parts are hit similarly. With tight margins typical in finishing, paying more for base materials, without adjusting quotes, could quickly erode profitability. That means businesses must adapt quickly: tightening waste-reduction efforts, improving quality control, and embedding metal surcharges into pricing.

Strategic Responses: Pricing and Sourcing

To defend margins, many firms are switching to index-plus or cost-plus pricing models. Under these frameworks, the price quote transparently adds LME base price plus the current Midwest premium, passing surges directly to customers. This clarity builds trust and shields margins. Others are exploring Midwest premium futures or adding escalation clauses in long-term contracts to lock in pricing pathways.

On sourcing, the sharp rise in premiums made scrap aluminum imports profitable—imports increased by over 30% in Q1 2025 and remain exempt from the new duties. By shifting to recycled aluminum, companies can reduce landed costs without sacrificing quality, especially when alloys and specs align.

Lean operations also pay dividends. Process improvements, such as reducing scrap, optimizing energy usage in finishing lines, and minimizing rework through tighter quality control, directly counterbalance material cost inflation.

Staying Ahead: Market & Policy Monitoring

Aluminum markets remain volatile. Premium futures are shifting, with premiums possibly rising to 76¢/lb. On the trade front, new tariffs or loopholes (like the UK’s 25% tariff waiver through July 9) could reshape supply channels. It’s crucial for businesses to track developments and consider joining industry associations to influence policy and understand carve-outs.

What Companies Can Do Next

To stay resilient:

- Revise pricing and contracts: Make metal surcharges explicit. Use indexed pricing and add escalation clauses tied to the Midwest premium.

- Diversify sourcing: Blend recycled, domestic, and international scrap aluminum to maximize efficiency and sustainability. Use alloys that perform to spec with recycled material.

- Optimize operations: Launch lean programs focusing on scrap reduction, energy efficiency, and process accuracy to cut waste.

- Communicate cost drivers: Tell clients about surcharge rationales and cost changes, building understanding and alignment.

- Engage strategically: Track tariff updates, market data, and regional exemptions. Partner with trade groups to shape future policy.

Final Takeaways on Aluminum Tariffs

The 50% aluminum tariff has created a cost inflection point across industries, from manufacturing to metal finishing. While it raises raw material prices and introduces uncertainty, smart, transparent pricing models, recycled sourcing, and lean operational practices offer strong tools to preserve margins and even find new advantages in this environment.

Connect with Light Metals Coloring for help building tariff-aware pricing, sourcing recycled aluminum, and streamlining finishing processes, so you can remain agile and profitable in these shifting market conditions.